Home > All journals > Intertax > 52(3) >

$25.00 - Rental (PDF) *

$49.00 - Article (PDF) *

Nicolas Traut, Gustavo Weiss de Resende

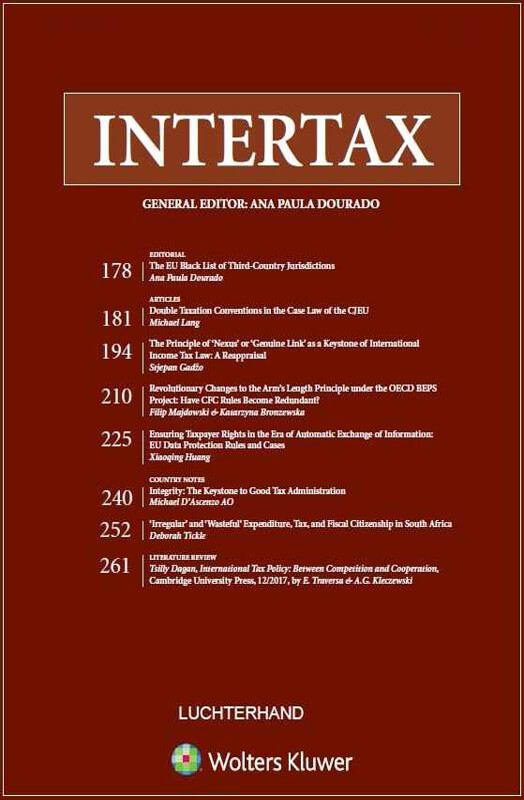

Intertax

Volume 52, Issue 3 (2024) pp. 226 – 238

https://doi.org/10.54648/taxi2024023

Abstract

Over a span of several years, the Court of Justice of the European Union (CJEU) developed a framework for anti-abuse in the context of European law and particularly established criteria for justifying restrictions on the fundamental freedoms in the tax context. In tax cases on anti-avoidance that are more recent, however, the court has demonstrated a notable change in its stance towards this issue that represents a disruption in the consistent development of its jurisprudence on abuse. While the court covers the contradictions in its case law by passing an impression of continuity between disparate decisions, it is remarkable how recent rulings draw from Organisation for Economic Co-operation and Development (OECD) language. This reliance on concepts from a non-EU institution, however, leads to legitimacy concerns. The increasing importance of international organizations and public opinion – for example, in reaction to the Panama Papers – in shaping the international tax landscape is undeniable. While high-profile projects like Base Erosion and Profit Shifting (BEPS) and Global Anti-Base Erosion (GloBE) highlight international tax issues, they also exert political pressure on judicial bodies such as the CJEU which leads to less methodological decisions that will align the court with political interests. In this context, the CJEU’s acting as a political player at the borderline of its competences is to be viewed critically, especially regarding the recent shift in its case law on abuse and tax avoidance that leads to concerns over legal certainty.

Keywords

Anti-abuse principle, anti-avoidance jurisprudence, CJEU, international organizations, international taxation, legal certainty, legitimacy, political influence

Extract