Home > All journals > Intertax > 43(12) >

$25.00 - Rental (PDF) *

$49.00 - Article (PDF) *

Cécile Brokelind

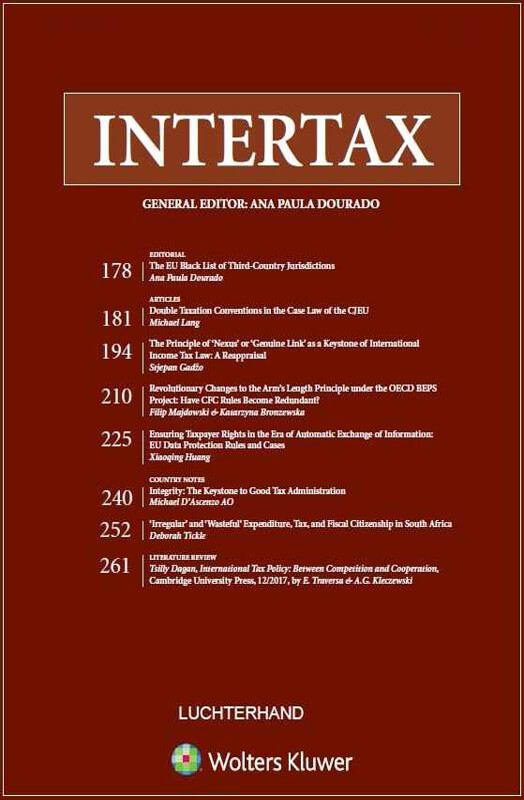

Intertax

Volume 43, Issue 12 (2015) pp. 816 – 824

https://doi.org/10.54648/taxi2015074

Abstract

This article identifies and analyses a number of questions raised by the amendments to the EU Parent-Subsidiary directive in respect of both the GAAR and the anti-hybrid rules. It capitalizes on the findings of previously published articles in this Review and concludes to an increased complexity, showing that Member States of the EU already had all necessary protective tools against ‘aggressive tax planning’ and did not need to amend the Directive.

Extract