Home > All journals > Intertax > 47(12) >

$25.00 - Rental (PDF) *

$49.00 - Article (PDF) *

Sara Coccia, Marcin Wrotniak, Yannick Zeippen

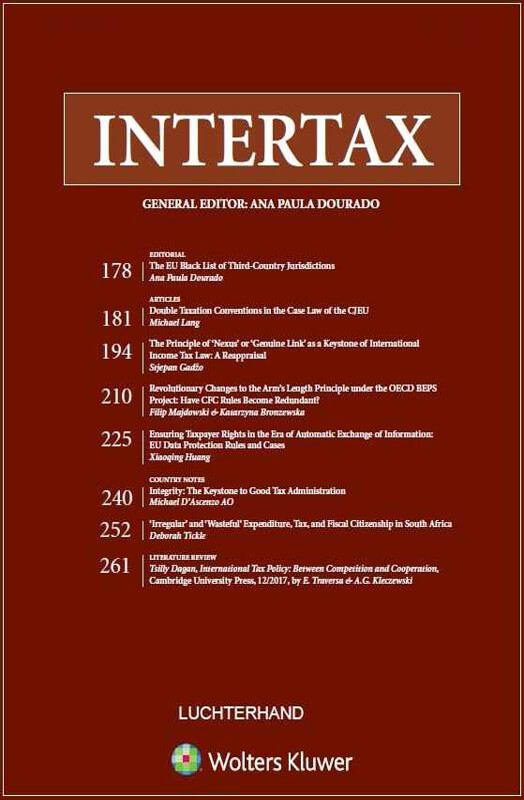

Intertax

Volume 47, Issue 12 (2019) pp. 1121 – 1124

https://doi.org/10.54648/taxi2019114

Abstract

On 13 June 2019, the Court of Justice of the European Union (the ‘CJEU’) released its decision in the IO case, C-420/18. In the case at hand, the CJEU ruled that a member of the supervisory board of a foundation, which in its status and duties, acts independently towards the said supervisory board or the foundation, but which however, when performing its activity does not act in its own name, on its behalf and under its own responsibility, and does not bear the economic risk arising from such activity, cannot be considered as carrying out an economic activity independently for VAT purposes. Hence, such person cannot qualify as a taxable person from a VAT perspective. The IO case adds to the EU VAT framework on the VAT status of members of independent bodies, by providing increased legal certainty on this point. Furthermore, the conclusions provided by the CJEU could be applied in assessing the VAT status of similar actors, such as self-employed counsels and consultants.

Extract