Home > All journals > Intertax > 42(6) >

$25.00 - Rental (PDF) *

$49.00 - Article (PDF) *

Sven-Eric Bärsch

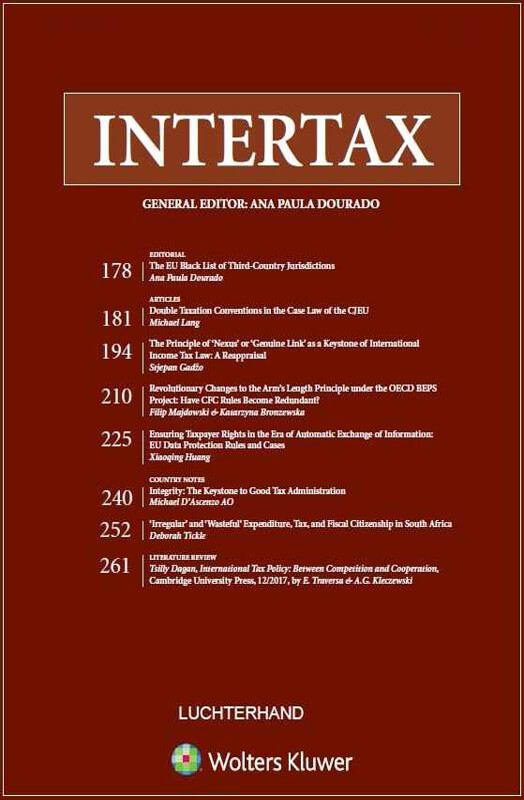

Intertax

Volume 42, Issue 6/7 (2014) pp. 433 – 444

https://doi.org/10.54648/taxi2014042

Abstract

Tax treaties distinguish between dividends and interest, and entitle recipients of this remuneration derived from financial instruments to different treaty benefits in the source country in particular. Hence, the definitions of dividends and interest for tax treaty purposes are decisive. This article presents and compares these definitions contained in the OECD Model and the tax treaties agreed by Australia, Brazil, Germany, Italy, and the Netherlands. It offers an analysis of the definitions of dividends and interest outlined in the German Model and reveals that legal certainty is not fully achieved. Moreover, the German Model does not comprehensively prevent the effect of hybrid mismatch arrangements.

Extract